The Competition and Markets Authority (CMA) has initiated an investigation into Google to determine if its search and advertising services are producing fair outcomes within the UK. Today, the watchdog declared the commencement of its inaugural "strategic market status designation investigation" under the new Strategic Market Status (SMS) regime that came into effect on 1 January this year, as reported by City AM. The inquiry will scrutinise the effects of Google’s services on UK consumers and businesses, including publishers, search engine rivals, and advertisers. With Google's search services commanding over 90 per cent of search queries in the UK, the CMA emphasised the importance of ensuring these services benefit both businesses and consumers. "Millions of people and businesses across the UK rely on Google’s search and advertising services – with 90 per cent of searches happening on their platform and more than 200,000 UK businesses advertising there," said Sarah Cardell, CMA Chief Executive. "That’s why it’s so important to ensure these services are delivering good outcomes for people and businesses and that there is a level playing field, especially as AI has the potential to transform search services." The investigation aims to guarantee that individuals enjoy access to diverse services and full control over their data, while also fostering innovative services and preventing biased content, according to the CMA. The Competition and Markets Authority (CMA) in the UK is set to initiate a probe with the objective of maintaining competitive advertisement costs, reducing consumer prices, and affording emerging enterprises an opportunity to vie with established tech entities. The CMA has indicated its intent to conclude the inquiry within approximately nine months. "It’s our job to ensure people get the full benefit of choice and innovation in search services and get a fair deal – for example in how their data is collected and stored," said Cardell. "And for businesses, whether you are a rival search engine, an advertiser or a news organisation, we want to ensure there is a level playing field for all businesses, large and small, to succeed." This investigation is part of a wider effort to rein in big tech firms, as signified by Google's 2024 court defeat in the US over claims that it unlawfully sustained its internet search monopoly.

Gamified cyber-security learning platform venture, SudoCyber, has secured a seven-figure equity investment to support its growth plans. The Brecon-based firm has received a £1m investment from the £130m Investment Fund for Wales, which was launched in November 2023 by the economic development bank of the UK Government, the British Business Bank. The £50m equity element of the fund is managed by Foresight Group, which has made its fourth investment and its first in Mid Wales. SudoCyber founders Jason Davies, Marc Del-Valle and John Davies have all served in the armed forces. he investment bolsters its growth plans for their gamified training which is used by the military, police, academia and industry. Established three years ago, the business began by training military personnel and has expanded to train cyber-crime police officers. Last year it won a three-year contract to train officers across all UK forces and the UK’s 10 regional organised crime units. The firm also services most universities in Wales, including Cardiff, Wrexham and south Wales. In its first funding round, SudoCyber said it will enable its 11-strong team to expand and recruit to further develop services, build the sales and marketing team, as well as expand internationally. As part of Foresight’s investment, the SudoCyber team will be supported by Geraint McGrath, senior investment manager at Foresight, who has been appointed to the board. A military background has been crucial to the team’s success. Mr Del-Valle, chief executive of SudoCyber, has more than 20 years of experience creating and delivering bespoke tactical and strategic communication instruction as part of his role within the British Army. He said: “With the ever-evolving landscape of cyber threats, it is essential that organisations maintain a knowledge of cutting-edge cybersecurity. We have equipped soldiers with the necessary skills to counter nation-state threats and this previous experience, insight and expertise has contributed to our success. “From very early conversations with Foresight, we realised that we were aligned in driving the issue of cyber security forward.” SudoCyber chief executive and co-founder Mr Davies, said: “We’re excited at the prospect this equity investment presents. We have ambitions to further develop the gamified elements of our learning platform, and to expand our client base in the UK and internationally. “This includes reaching out to more universities where lecturers in cyber security appreciate being able to outsource some modules to benefit from our expertise.” Bethan Bannister, senior investment manager, nations and regions investment funds at the British Business Bank, said: “The Investment Fund for Wales was established to provide the financial backing that innovative and ambitious companies like SudoCyber so often need, and we are particularly pleased to support their growth plans as they continue to scale. “The SudoCyber team is expert within this specialist and increasingly vital sector, and they have established an impressive roster of clients. “We look forward to tracking their success following this significant investment.” Mr McGrath said: “We are very pleased to support SudoCyber with this significant £1m investment, marking our first investment in mid Wales and underscoring our commitment to supporting the growth of dynamic Welsh businesses. “With this investment, SudoCyber is poised to enhance its capabilities, expand its team, and broaden its market reach. We look forward to partnering with Jason, Marc, and John on their exciting growth journey.” Mr McGrath said: “We are very pleased to support SudoCyber with this significant £1m investment, marking our first investment in mid Wales and underscoring our commitment to supporting the growth of dynamic Welsh businesses. “With this investment, SudoCyber is poised to enhance its capabilities, expand its team, and broaden its market reach. We look forward to partnering with Jason, Marc, and John on their exciting growth journey.” Advisers Foresight: SME financial advice by FosterDenovo Dynamic Portfolios Legal advice by Blake Morgan SudoCyber:

An IT services company has struck a new deal with Birmingham City FC. Intercity has become the club's official IT support partner for the next three years. The Birmingham-based company will be responsible for upgrading the club's IT systems and cloud servers, providing matchday stadium support and enhancing network connectivity at the training ground among other work. A support engineer from Intercity will also be on site to provide technical support. Intercity has doubled its workforce to 325 over the last five years. This latest deal with League One Birmingham City follows similar tie ups with Warwickshire County Cricket Club and their home of Edgbaston stadium. Chief executive Charlie Blakemore said: "We are incredibly proud to partner with Birmingham City FC, a cornerstone of our local community. "This strategic partnership represents a great synergy between two Birmingham-based organisations with deep and passionate roots in the city. "Our focus will be on helping the football club with its digital transformation, a critical journey that will boost operations and allow them to focus on their performance both on and off the field. "We have always prioritised building strong partnerships within the community and adding Birmingham City to our roster is not only a tremendous honour but a fantastic vehicle for doing good in the local areas we operate in. "There is a real vision and desire from the owners to use football to regenerate places and lives and we will ensure they can do that through the most appropriate use of technology and by driving shared connections in the city." Birmingham City chief executive Garry Cook added: "We took over 18 months ago and the focus was on fixing and building the football club.

Offshore digital tech firm Kinewell Energy has its sights on further expansion into the Asia-Pacific following backing from Innovate UK. The Tyneside-based creator of software that helps offshore wind farm developers lay out turbines and connecting cabling has translated its suite of systems into Japanese and Korean - both expanding markets in which the firm hopes to do more business. Kinewell has already enjoyed some initial success in the Asia-Pacific market, having last year launched the Kinewell Wake-Optimisation Turbine Arrangement solution - an AI-powered software for calculating the best position of offshore wind turbines - at the Global Offshore Wind Summit in Fukuoka in Japan. In South Korea, the firm has supported the early development of the 600MW Wando-Guemil offshore wind project in the Yellow Sea, helping Blue Wind Engineering to find the best location for the offshore substation and optimise the project's inter-array cable layout. This week, some of the firm's North Shields-based team have travelled to Taiwan, Japan and South Korea to meet clients and drum up further business. They will attend the APAC Wind Energy Summit in Incheon, South Korea. Founder and CEO Dr Andrew Jenkins said: “We’ve already worked with six companies in Japan and three in South Korea to deploy our SaaS optimisation tools and provide consultancy services. One of our Japanese clients has also recently renewed its subscription to continue using our KLOC inter-array cable layout optimisation solution, and the demand for our services in the market is continuing to grow. "This is why we decided to translate our software solutions into Japanese and Korean, to make it easier for clients to use our tools through their native language, and we’re thankful to Innovate UK for helping make it possible to do so. We see strong demand and growth across the whole of the Asia-Pacific region for our offshore wind design optimisation tools and the funding and support from Innovate UK will really help us to grasp the lucrative opportunities this increased demand will present.” Government support for Kinewell has come via Innovate UK, part of UK Research and Innovation (UKRI), through its Net Zero Living: User focused design competition. It allowed Kinewell to make its software solutions as easy to use as possible through user-focused design principles and work with the Design Council, as well as funding for the language translation.

Payments tech firm Card Industry Professionals has been acquired by New York Stock Exchange-listed Shift4 in an undisclosed deal. The Northern Powerhouse Investment Fund (NPIF)-backed business has become part of Shift4's global operation which processes $260bn of transactions annually. The deal represents an exit for Mercia Ventures, which backed the firm in 2022 to the tune of £850,000 using NPIF and Midlands Engine Investment Fund money. Card Industry Professionals was launched in 2017 by young entrepreneur Ciaran Savage, who was joined by his month, Lyn Savage as operations director and John Selby as sales director. The Aylesby-based firm now employs 20 people and has a network of more than 150 sales agents, and processes more than £60m of transactions each month. Ciaran Savage, founder and managing director, said: "We are excited to be joining the Shift4 family. We are committed to upholding the company values and best-in-class service customers have come to expect from us and are confident that this acquisition will allow us to improve upon those service levels, while offering even more value in the form of new benefits, incentives and product offerings." Maurice Disasi of Mercia Ventures added: "We’re delighted to have supported CIP on its growth journey. Ciaran and the team have built a business with first-class customer support and Shift4 now has the benefit of adding a strong and well-respected team here in the UK as part of their global operations. We wish the team continued success."

A County Durham couple will become the latest regional business to brave the Dragons’ Den this week. Zara Paul and Aaron Morris are the founders of Choppity, a Belmont Business Park company behind a web-based AI video editing platform which is set to appear on the new series of the BBC pitching programme on Thursday in a bid to secure investment for their start-up. The co-founders and married couple only launched Choppity in 2023 with a vision to simplify the video-editing process for podcasters and businesses. The platform, which was founded in Durham, is already used in production by companies including ITN, Autotrader, Turtle Bay, and Sonatype, with features including AI subtitles, in which Choppity instantly adds subtitles to podcast clips, and Magic Reframe, which instantly turns a landscape podcast into a portrait or square one to make sure every speaker’s face can be seen. Before taking on the Dragons, the pair said their number one target for investment was entrepreneur and host of one of the world’s most listened-to podcasts, Diary of a CEO, Steven Bartlett. Zara proudly represents the LGBTQ+ community as an openly non-binary contestant, and said the experience was “important and deeply personal”. Zara said: “It was an unforgettable moment to be in that room, presenting something we’ve worked so hard on. The setup felt incredibly stripped back - just the two of us and a screen in front of the five established entrepreneurs. It was both nerve-wracking and exhilarating. “The startup world, and the media more broadly, often feel bare of LGBTQ+ representation, especially for gender non-conforming and trans founders. I hope this moment inspires others to pursue their ambitions and know they belong here too.” In a LinkedIn post the firm said: “After months of secrecy, we’re so excited to finally reveal the news. Watch the episode this Thursday 16th January, 8pm on BBC 1 to find out what the Dragons thought of Choppity. For those that have been following our company’s journey for a while, I hope you have fun watching this episode! “We’re extremely grateful for the opportunity to showcase Choppity on a national stage. To all of our users, customers and supporters, thank you for helping us get here.”

Prime Minister Keir Starmer has announced 1,000 new tech jobs for Liverpool City Region as he pledged to 'relight the fires of innovation' through Artificial Intelligence (AI). The PM told BusinessLive's sister title the Liverpool Echo that American group Kyndryl, the world's leading IT infrastructure services provider is set to open a new tech hub in the Liverpool City Region, which will generate 1,000 jobs over the coming three years. Sir Keir told the Echo: "Liverpool voted for change in July. And my Labour government has been working tirelessly to deliver on that change. We're starting to reap the rewards of that hard work. "Last November I visited Runcorn to announce 2,000 jobs in the region - thanks to our £22 billion investment in Carbon Capture. Today I can announce that yet more jobs are coming as Kyndryl has committed to an extra 1,000 AI-related jobs over the next three years. He continued: "These are jobs of the future that will relight the fires of innovation across the Liverpool City Region. It means working people - from the Wirral to St Helens - will feel the change we promised. "I promised the Echo that I would turbocharge this great region, and here is the proof. Working hand in hand with Mayor Steve Rotheram, today's announcement shows how Labour in power is delivering for working people." Sir Keir's government said the new tech hub "will share the government's ambition to roll AI out across the country to help grow the economy and foster the next generation of talent." The Liverpool news comes as part of a broader government announcement, which states that AI will be 'unleashed' across the UK in an effort to "help turbocharge growth and boost living standards". The Prime Minister unveiled details of the government's AI Opportunities Action Plan today, stating that AI can "transform the lives of working people". Sir Keir added that the new technology "has the potential to speed up planning consultations to get Britain building, can help drive down admin for teachers so they can get on with teaching children, and feed AI through cameras to spot potholes and help improve roads. " The Prime Minister emphasised his government's commitment to this industry by agreeing to implement all 50 recommendations set out by Matt Clifford in his "game-changing" AI Opportunities Action Plan. The Prime Minister said: "Artificial Intelligence will drive incredible change in our country. From teachers personalising lessons, to supporting small businesses with their record-keeping, to speeding up planning applications, it has the potential to transform the lives of working people. "But the AI industry needs a government that is on their side, one that won't sit back and let opportunities slip through its fingers. And in a world of fierce competition, we cannot stand by. We must move fast and take action to win the global race. "Our plan will make Britain the world leader. It will give the industry the foundation it needs and will turbocharge the Plan for Change. That means more jobs and investment in the UK, more money in people's pockets, and transformed public services. That's the change this government is delivering." Chancellor Rachel Reeves said: "AI is a powerful tool that will help grow our economy, make our public services more efficient and open up new opportunities to help improve living standards. "This action plan is the government's modern industrial strategy in action. Attracting AI businesses to the UK, bringing in new investment, creating new jobs and turbocharging our Plan for Change. This means better living standards in every part of the United Kingdom and working people have more money in their pocket."

Bosses at touch screen technology maker Zytronic are looking for a buyer to protect jobs, but have not ruled out the possibility of closing entirely. The Blaydon-based maker of products for the international gaming and vending markets has appointed restructuring specialists FRP Advisory having concluded a consultation about its future. It told investors on the London Stock Exchange that it will now seek a sale of the business, or a wind down of its assets leading to a solvent liquidation. Zytronic employs about 110 people at its Tyneside facility which had supplied touch-screens for a broad range of uses - from electric vehicle charging stations to casino slot machines. The firm has repeatedly warned of lacklustre trading in recent years and recently said efforts to turn around the position had "not delivered meaningful results”. In its latest update to the market, the firm said the decision to either sell or wind up the business had been "reinforced by continuing weakness in trading conditions with no material uplift in order intake". Last month, and in a bid to reduce costs, Zytronic had indicated it could de-list from the AIM stock market where its shares have been traded since 2000. The firm's share price has fallen considerably over the last two years. Most recent unaudited full year results show revenues fell from £8.6m to £7.2m in the year to the end of September - a marked disappointment for the company which had expected to see a 22% increase in revenues in the second half of the year but came to the conclusion it was unlikely to see a recovery in the short to medium term. Bosses said FRP will now run a process to maximise returns for shareholders, which might involve a sale of the group's main trading company - Zytronic Displays Ltd - as a continuing business or a sale of its underlying trade, intellectual property and assets. As part of the process, an "outcome report" will be prepared to provide an estimate of returns to shareholders. Zytronic said: "As highlighted in the Strategic Review Announcement, there can be no guarantee as to returns that may be available at this stage. A further announcement will be made in due course." Christopher Potts, chair of Zytronic said: "This decision has not been taken lightly. Whilst the board had confidence in the opportunity presented by the transformation plan, we collectively felt duty bound to present it alongside the different options available to shareholders at this important juncture for the company. Our focus will now be on ensuring a suitable buyer is found for ZDL to protect jobs in this important business based in the North of England and interested parties should contact FRP Advisory."

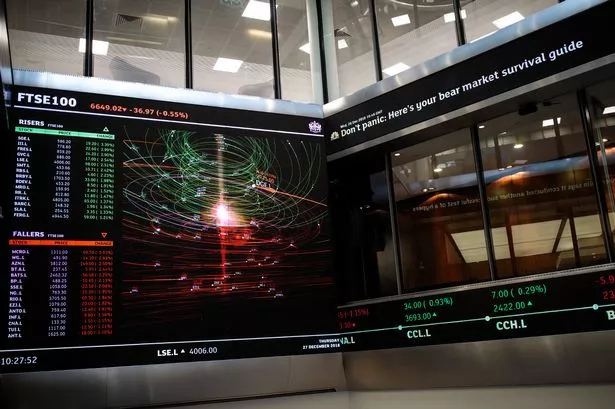

Vodafone, the FTSE 100 telecoms behemoth, has announced a surge in operating profit today, maintaining its financial forecast for the year following a series of asset sales. The firm informed the market this morning that revenue for the first half of its fiscal year had increased by 1.6 per cent to €18.3bn (£15.2bn), with growth in service revenue partially offset by unfavourable foreign exchange movements, as reported by City AM. Overall, service revenue rose by 1.7 per cent to €15.1bn on a reported basis and 4.8 per cent organically. Vodafone's German division saw the most significant slowdown, with revenue falling 6.1 per cent in the second fiscal quarter. Meanwhile, revenue at Vodafone's business arm grew four per cent in the second quarter, while organic growth at its African business reached 9.7 per cent. The FTSE 100 company reported an overall operating profit of €2.4bn in the first half, up 28.3 per cent, primarily due to a €0.7bn gain from the sale of an 18 per cent stake in Indus Towers. Adjusted earnings before interest, tax, depreciation, amortisation and adjusted lease liabilities (EBITDAaL) on an organic basis rose by 3.8 per cent to €5.4bn. The company attributed this growth to service revenue growth and reduced energy costs in Europe. Vodafone reaffirmed its full-year guidance for adjusted EBITDAaL of €11bn and adjusted free cash flow of at least €2.4bn. The telecommunications behemoth announced the near completion of its second €500 million share buyback programme, having repurchased 1.2 billion shares for a total cost of €1 billion by 11 November 2024. Vodafone's CEO Margherita Della Valle remarked: "We continue to make good progress on our strategy to change Vodafone. The approval processes for our transactions in the UK and Italy are nearing conclusion. These will complete our programme to reshape the group for growth. We are also investing in Germany to strengthen our market position and taking steps to expand our B2B capabilities." Della Valle added, "As we move through this year of transition, our results in the first half have been consistent with our expectations and we are reiterating our full year guidance. We grew service revenue by 4.8 per cent and adjusted EBITDAaL by 3.8 per cent. We delivered good performances across our markets, with the exception of Germany, where we have been impacted as expected by the TV law change." She concluded with confidence, "I am confident that the actions we are taking will deliver growth for Vodafone this year and a further acceleration into FY26." In a difficult environment where competition is fierce, Richard Hunter, Head of Markets at interactive investor, has acknowledged Vodafone's initiatives towards asset disposals and cost reduction, but notes the company has significant strides to make to assure the market of its recovery trajectory. Richard Hunter commented: "For Vodafone, years of underperformance are being addressed, with a major transformation of its business well underway. Even so, turning around a super tanker is never an easy task, especially when the company is in the midst of a highly competitive arena." He further noted: "There is little to catch the eye of the bulls in this release, with the end game still some way off, and the share price has reacted accordingly. The decline adds to a drop of 4 per cent over the last year, which compares to a gain of 10.4 per cent for the wider FTSE100 and the not so steady decline the shares are down by 70 per cent over the last ten years and by 54 per cent in the last five leaves the price languishing at multi-decade lows."

Making the Northern games industry more diverse could help it to more global success – that was the message from one of a series of events this week aimed at growing the thriving video games industry. Liverpool City Region has a long heritage in video games and hosts many companies in the sector today supporting thousands of jobs. But the industry does face skills challenges. Last year, metro mayor Steve Rotheram and the Combined Authority’s Careers Hub launched the GameChangers scheme to promote local talent. On Thursday, Liverpool hosted the Develop North conference to showcase its video games sector to the world. The keynote was delivered by the leadership team from the city's Wushu Studios. On Friday morning, GameChangers Liverpool City Region will hold an event at FACT aimed at tackling what the organisation calls a “skills crisis”, as companies find it hard to hire for technical roles and as educational providers battle to keep up with the sector’s ever-changing technology. GameChangers says the industry must invest in local talent “to grow a local cohort of candidates that are properly equipped for a modern games industry”. On Wednesday, Liverpool Game-Dev Network teamed up with #RaiseTheGame, an industry-wide equality, diversity & inclusion (EDI) project, to host panel debates on the future of the sector – including a discussion about authenticity and diversity in the workplace. The event was organised by Marek Smagala, founder of Liverpool Game Dev Network, and Dominic Shaw, who facilitates and runs the #RaiseTheFame initiatives with Ukie. Alison Lacy, co-chair of Liverpool GameChangers, said some in the games industry historically felt they should focus on money or art rather than thinking about diversity. But she said that making an effort to reach diverse audiences would bring those rewards, by ensuring that games could reach far wider global audiences. She said: “Diversity will bring lots of money. And it will bring fantastic art. That’s the great thing about it.” Alison also talked about how industry leaders should avoid the temptation to hire people just like them – “don’t ask personal questions to find people who share the same hobbies as you". Louise Andrew, head of art at d3t Ltd added that different people bring different strengths – and said successful companies could “celebrate differences” in their workforce while allowing people to be themselves at work. Chloe Sinclair, engagement manager at Climax Studios and a specialist in equality, diversity & inclusivity (EDI) initiatives, said the industry needed to continue to “build up voices that aren’t at the table.” One area where she said companies could be more accessible is in recruitment – for example being clear about definitions of “remote” work The event also talked about the importance of authenticity in the workplace, and about being honest leaders to help ensure staff could reach their full potential. Both Chloe and Liz Prince, business manager at games recruitment specialists Amiqus, and said leaders should lean into their strengths, acknowledge where they need to develop their skills, and and hire people to fill those gaps. Liz said a happy team “will benefit you commercially, enormously”. Another panel session at the event focused on the indie gaming experience in the North West – discussing issues including fundraising. It was hosted by Hannah Wright from Recruitment Heroes with panellists including Jonathan Holmes, CEO and founder at Milky Tea Studios and Alex Moretti, CEO at Fallen Planet Studios.

A Tyneside technology firm is embarking on the acquisition trail after sealing a £7m investment to fuel its growth. ITC Service, an IT managed service provider based in Hebburn, South Tyneside, was founded in 2016 by Christopher Potts and Peter Anderson and over the years it has grown to deliver outsourced IT services to more than 400 SMEs across the North East. The company is seeing growing demand for its services, which include managed IT support, cyber security, Microsoft 365 cloud services, voice, communication, consulting and digital transformation. Now ITC has secured the seven-figure sum from growth capital investor BGF in a deal which will allow it to continue to scale through a combination of organic growth and acquisitions, including complementary companies in neighbouring regions. Mr Potts, founder and director, said: “Over the last 18 years, we have built a highly successful, respected business that has developed a strong and valued client base. With the ongoing support of my co-founder Peter, I am excited to lead ITC forward, to continue to grow and support our region, to help more local businesses achieve their goals and complete a carefully executed M&A strategy. “In order to fulfil this potential, we need an investment partner that is willing to take a long-term approach to support our growth ambitions. With an excellent track record of backing exciting and dynamic businesses in the North East, we are confident BGF is the right choice and we’re delighted to have the team onboard.” The deal was led by John Healey and Christian Pollard, investors in BGF’s Newcastle team. As part of the investment, Lee Shorten will join the board as non-executive chair. BGF investor Mr Healey added: “ITC is a real success story in the North East, where it has a long-established track record of delivering exceptional client outcomes. With an appetite to accelerate growth, through a leading service offering combined with a client focused approach, ITC is well positioned to expand its footprint in the regional market.” BGF, which has funding from a number of the UK’s largest banks, was set up in 2011 and has invested £4bn in more than 600 companies. It describes itself as the most active investor in the UK and says it takes minority, non-controlling stakes with a “a patient outlook on investments”.

A major recruitment drive has been opened up by Newcastle's iamproperty as it plans to create 100 jobs over the next 18 months. The Gosforth-based provider of technology for online property auctions says it will initially focus the expansion on its residential conveyancing arm, Medway Law. It is part of a move to capitalise on continued rises in auction transactions. To begin with, 20 roles are being advertised across its conveyancing and business support services. In February and March, more than 20 roles will be available for auction specialists. Bosses say the move comes on the back of demand for iamproperty's auction solution driven by buyers and sellers looking for fast sales ahead of the Stamp Duty Land Tax deadline in April. That is when the threshold band on residential properties will reduce from £250,000 to £125,000. Iamproperty, which employs 700 people, is said to be the UK's largest online residential auctioneer and reports that the number of properties sold by auction was up by 28% in December last year, compared with the year before and bidding activity was up 64%. The firm says that auctions can offer 56-day completion timescales from receipt of draft contracts, based on a standard property. Ben Ridgway, co-founder at iamproperty, said: "We’re pleased to be expanding our 150-strong team within Medway Law with these new legal roles. We know some redundancies were faced in the industry before Christmas and are keen to hear from people with experience who want to be part of modernising the property market and driving innovation. "We’re committed to making the moving process better, faster, and more secure for everyone involved, and we’re in it for the long term. We’re looking forward to welcoming successful candidates who share our vision. "The market conditions mean that auction is helping support buyers with quick sales to make Stamp Duty savings and is the current focus of our recruitment efforts. However, we will be creating opportunities in multiple areas of the business as we continue to realise our ecosystem vision to drive real change in the property market." Plans to increase headcount at iamproperty follow several years of the growth, including 2023's investment from private equity backer Perwyn in a deal believed to have topped £100m. Iamproperty was founded by Jamie Cooke and Ben Ridgway in 2009 as they spotted a gap in the market for a property auction service that benefited estate agents and buyers.

London has retained its position as the world's tech capital, according to a highly-regarded league table, while New York is inching closer to reclaiming the top spot. The Z/Yen Smart Centres Index, which ranks 77 global commercial hubs based on their ability to innovate, develop and implement technology, revealed that London continues to hold the first place, a title it has maintained since surpassing New York last May, as reported by City AM. In the most recent edition, New York regained second place after falling behind Zurich six months prior. The gap between London and New York has shrunk by six points since May, with London's score recently decreasing by seven. San Francisco ascended four places to secure fourth place, trailing Zurich. Oxford and Cambridge, recognised as influential global tech hubs, dropped by four and one places in the ranking respectively. The new UK government has positioned Britain’s tech industry at the heart of its pledge to attract more international investment and foster a supportive environment for start-ups. At Labour’s flagship investment summit last month, US companies CyrusOne, Cloud HQ, CoreWeave and ServiceNow committed a combined £6.3bn in funding for the UK’s data centre industry to cater to the nation’s growing demand for AI and machine learning. Jersey was the only location in Z/Yen’s top 20 to witness an increase in its score over the past six months, with the average rating across the index falling 1.07 per cent. According to recent numbers, confidence appears to be waning in global technology centres, a trend that Z/Yen attributes to the ongoing geopolitical tensions and economic instability. Commenting on the current state of sentiments, former Lord Mayor of the City of London and Z/Yen chair Michael Mainelli said: "The latest results in the SCI show a slight dip in confidence in the strength of centres, and confirmation that strengths in AI, digital, and computing skills will have a major impact on centres’ performance."

Apple is bracing itself for a legal battle on Monday, marking the first instance of a major tech company in the UK answering to a class action lawsuit over accusations of imposing "excessive and unlawful" charges through its App Store. The claim, seeking up to £1.5 billion in damages, was initiated in 2021 at the Competition Appeal Tribunal on behalf of approximately 20 million Apple users, as reported by City AM. Critics argue that Apple has effectively stifled competition by obligating customers to use its proprietary payment processing service, levying a 30 percent commission on app store transactions and charging developers additional fees for in-app purchases. This approach, the plaintiffs assert, allows Apple to reap "unlawfully excessive levels of profit". Brought forth by law firm Hausfeld on behalf of Dr Rachael Kent of King’s College London, serving as the class representative, the lawsuit suggests 19.6 million UK consumers could qualify for compensation. While Apple has dismissed the action as "meritless", it has expressed eagerness to present its steadfast dedication to consumer welfare and the positive impact of the App Store on the UK’s innovation sector to the court. A preliminary session was convened in September to deliberate upon the relationship between this lawsuit and another similar case, Dr Sean Ennis v Apple. In November, the Tribunal decided that these proceedings would proceed as usual, separate from the Ennis proceedings, which will be managed independently. Apple is the first Big Tech company to face trial under the UK collective action regime.

A County Durham firm pioneering work in tagging technology has sealed a £3.25m investment round. PervasID, a leading innovator in RFID (Radio Frequency Identification) tech, was launched as a Cambridge University spin-out 13 years ago, but launched a second base at NETPark in Sedgefield earlier this year to tap into the skills and expertise within the region’s growing tech cluster. The business was launched by Dr Sabesan Sithamparanathan and a number of colleagues from Cambridge, spinning out from the university’s engineering department after getting attention from the retail, security and logistics sectors with its cutting-edge real-time location tracking system. The basis for RFID tracking has been around since World War Two but, until recently, it only worked within a couple of metres of a tag with accuracy of around 80%, whereas the PervasID Track Master can deliver near 100% accuracy at a range of up to 20m. Now PervasID has secured £3.25m in a funding round led by Parkwalk Advisors, which includes investment from two Maven-managed regional funds: a £375,000 investment from the Finance Durham Fund established by Durham County Council and overseen by Business Durham, and a £375,000 investment from the Northern Powerhouse Investment Fund II (NPIF II), supported by the British Business Bank. The deal will help fund PervasID’s team at NETPark to expand its customer base, following increasing demand from large customers in retail and aerospace. The investment will also support further R&D to enhance its software products offering in data analytics to complement its world-leading hardware solutions. Peter Oram, CEO of PervasID, said: “We are delighted to close out this first phase of our investment round with the support of Parkwalk and Maven. Maven is joining us at what is a very exciting time in our journey as we head towards a new chapter. The growth we have seen in recent years is a testament to our market-leading innovation and we can’t wait to use this investment to take the business to the next level.” Sarah Slaven, managing director of Business Durham said: “We are delighted to support PervasID’s journey through the Finance Durham fund, strengthening their position within the thriving technology cluster at NETPark. Their decision to expand from Cambridge last year reflects the benefits of NETPark’s collaborative environment and highly skilled workforce, which offer a strong foundation for pioneering companies like PervasID. We look forward to seeing them succeed as part of NETPark’s innovative community, helping to drive economic growth and foster cutting-edge developments in County Durham.” Rebecca MacDermid, investment manager at Maven said: “PervasID’s passive RFID tracking technology is world-leading in terms of accuracy over range, and we are excited to work with industry experts Pete and Sabesan as they navigate a business that is on the cusp of rapid growth, with some exciting customers lined up across a range of sectors.”

North East software development company Leighton has relocated its regional headquarters to a prime office scheme in Newcastle city centre. Leighton, which specialises in building software products and optimising processes for customers, had been based at The Core at Newcastle Helix, but has now moved its head office to the 14-storey Bank House in Pilgrim Street. The company has taken space within the Cubo offices, the top two floors of the building that the flexible workspace provider opened up last year. Leighton reached a significant milestone as it celebrates the growth of its team to 100 colleagues following another year of sustained growth. The office – the first site for Cubo in the North East – gives members a 360-degree panoramic view of the city’s skyline. The company said it saw a 31% increase in revenue during its 2024 financial year and is set for another year of record performance at the end of the 2025 financial year, with projected growth in the double figures, through its work with customers including British Airways, Atom Bank, Equans, IAG Loyalty and Greggs. James Bunting, CEO at Leighton, said the relocation reinforces its commitment to maintaining headquarters in the North East while supporting its growing hybrid workforce, who will be able to take advantage of Cubo’s national network of locations. Mr Bunting said: “This transition marks a significant milestone for Leighton, as we continue to invest in an environment where our team and customers can come together to thrive, collaborate and innovate. Access to Cubo’s office network across the UK is important to us as it will ensure all of our team will have access to spaces where great work happens, and our culture comes to life. It also reflects our ongoing commitment to retaining a headquarters in the North East and supporting the growing tech sector in the region.” Last year the business made key strategic appointments, which included welcoming Lee Gilmore as principal solutions architect, and Clare Gledhill as chief consulting officer to lead on the company’s consultancy offering. Mr Gilmore added: “The tech sector in the North East is a growing hub and we’re only going to see more focus, business, and talent around what is already a thriving sector. It’s great to be working with like-minded individuals who are so invested in cultivating and growing the amazing talent already working in the region.”

Consumer rights organisation Which? has lodged a £3bn lawsuit against Apple, accusing the tech giant of breaching UK competition law with its iCloud services. Which? alleges that Apple has been favouring its own iCloud storage services and making it challenging for customers using Apple devices to utilise alternative data storage providers, as reported by City AM. The claim, submitted to the Competition Appeal Tribunal, suggests that customers are effectively locked in as Apple does not permit them to store or back-up all their phone's data with a third-party provider. Consequently, iOS users have to pay for the service once they exceed the free 5GB limit. Which? argues that this lack of competition results in consumers being overcharged annually on their monthly iCloud subscription fees. The lawsuit points out that Apple has increased the price of iCloud for UK consumers by between 20 per cent and 29 per cent across its storage tiers in 2023. Which? is now seeking damages for affected Apple customers who have used iCloud services since 1 October 2015. The group estimates that individual consumers could be owed an average of £70 depending on the duration they have been paying for the services. Anabel Hoult, chief executive of Which?, has claimed that Apple customers are due nearly £3 billion due to the tech giant's imposition of its iCloud services on consumers and stifling competition from rival services. "By bringing this claim, Which? is showing big corporations like Apple that they cannot rip off UK consumers without facing repercussions." she stated. A similar case against Apple regarding this issue is already underway in the US, but it has not yet reached a conclusion. In response to the claim, an Apple spokesperson defended the company's practices: "Apple believes in providing our customers with choices. Our users are not required to use Icloud, and many rely on a wide range of third-party alternatives for data storage."

A Leeds cybersecurity company has sealed a grant with more than £580,000 to deliver new tech to help ecommerce retailers in Singapore. Veracity Trust Network has been awarded the CyberCall grant of $1m Singapore dollars – which amounts to around £585,694 – from the Cybersecurity Co-Innovation and Development Fund (CCDF). The grant, awarded by the Cyber Security Agency Singapore (CSA), will be used to develop and deliver advanced malicious bot detection in collaboration with one of world’s largest fashion retailers. Veracity was selected because of its Beyond the Edge technology, which uses real-time behavioural analysis to detect and block complex bots. Veracity’s data shows that around 30% of all website visits are malicious bots looking to do harm. The grant will be used to develop and deliver the next generation of the technology, which will provide advanced malicious bot detection tailored to the ecommerce company’s operations. Nigel Bridges, group CEO at Veracity Trust Network, said the issue of malicious bots is become a growing menace, with more and more bots seeking to steal data, set up fake accounts, disrupt inventory and plant ransomware. Mr Bridges said: “The problem of malicious bots is serious and getting worse as technology advances. It’s a major issue that is growing in scale, sophistication and damage, with serious negative impact on all online organisations. In general, the eCommerce industry has been losing this particular arms race. Veracity was created to try to break the cycle and get ahead of malicious actors. This has clearly been recognised by the CSA, and we are honoured to have been selected by them.” The CCDF’s CyberCall grant encourages collaborations between cybersecurity companies and end-users while supporting the development of innovative cybersecurity solutions in Singapore. Veracity group CTO Stewart Boutcher, who has overall responsibility for the APAC region, was presented the Cybercall Innovator award by David Koh, Commissioner of Cybersecurity and chief executive of CSA. Mr Koh said: “Innovative Cybersecurity companies are vital to a thriving Cybersecurity ecosystem. My warmest congratulations to the winners of the 2023 Cybercall: all these companies are pushing the boundaries of cybersecurity innovation.”

A Bristol company that is developing an all-electric 'flying taxi' has struck a deal that will see it use artificial intelligence to speed up the testing of its aircraft. Vertical Aerospace, which was established by Ovo Energy founder Stephen Fitzpatrick in 2015, will work with AI software provider Monolith to improve the performance of its VX4 vertical take-off and landing (eVTOL) aircraft and accelerate its time to market. The South West-based firm will use AI for new design insights and more efficient test plans in less time, it said. The first project will focus on testing and simulation of the VX4’s supporting pylon structures for ground tests of the propeller and electric motor structural and performance requirements. "Flight and ground tests for eVTOL are incredibly complex, expensive, and time-consuming, typically requiring engineers to spend hundreds of hours validating simulations across tens of thousands of parameters and operating conditions," a spokesperson for Vertical Aerospace explained. London-based Monolith has a proven track record in aerospace engineering following recent projects with Airbus and BAE Systems on aircraft and drones. Dr. Richard Ahlfeld, chief executive and founder of Monolith, said: “Urban air mobility has the potential to revolutionise how we travel, and one of the most promising contributors to this transformation is Vertical’sVX4. "With Monolith, Vertical will model complex systems faster and accelerate test campaigns, enabling the company to learn more about design performance while reducing development and testing time.” David King, chief engineer of Vertical Aerospace, added: "Transforming how the world moves requires constant innovation. Collaborating with Monolith allows us to harness cutting-edge AI technology to streamline our testing processes, enabling us to focus on the most impactful areas and accelerate the VX4’s journey to market."

Nvidia's shares climbed 3.4% on Tuesday to $149.43 (£118.95) per share, putting it on par with Apple following a series of product launches at the CES event in Las Vegas. The tech giant unveiled an array of new offerings, including gaming chips, a personal AI supercomputer, and AI models for robotics and self-driving cars, as reported by City AM. Post-announcement, Nvidia's valuation soared to $4.66 trillion (£3.7 trillion), positioning it as the world's second-most valuable company, just behind Apple. Nvidia's CEO Jensen Huang highlighted the company's AI ambitions and potential growth in robotics, gaming, and autonomous vehicles, referring to robotics as a "multi-trillion dollar opportunity" in his keynote speech. This development follows Nvidia's brief stint as the world's most valuable company last year when its market capitalisation reached $3.43 trillion (£2.66 trillion) in November, surpassing Apple's $3.38 trillion (£2.62 trillion). Microsoft currently holds third place. Central to Nvidia's success is the introduction of the RTX 50 series, part of the Blackwell family, announced by Huang. These new gaming chips promise unparalleled performance and are expected to hit the market this month. Analysts at AJ Bell have emphasised the significance of this launch, stating: "The RTX 50 series will use Nvidia’s Blackwell AI technology to support highly detailed, hyper-realistic graphics." "This launch is a reminder that Nvidia is not just about AI; the business’ success was founded on gaming technology, and RTX 50 implies it remains on top of its ‘game", they said. Another significant announcement from Nvidia's CEO Jensen Huang was the unveiling of Project Digits, a desktop AI supercomputer priced from $3,000 (£2,387). Equipped with the new Grace Blackwell Superchip (GB10), Project Digits offers processing power previously exclusive to large-scale data centres. It can manage AI models with up to 200 billion parameters, expandable to 405 billion when two systems are connected. "AI will be mainstream in every application for every industry. With Project Digits, the Grace Blackwell Superchip comes to millions of developers", Huang declared. The compact design, similar to a Mac Mini, aims to make Project Digits accessible to data scientists, researchers, and students. Analysts predict this could significantly speed up AI adoption across sectors from healthcare to manufacturing. "Nvidia has unveiled something that promises to be faster and better than what’s already on offer", commented AJ Bell analysts. Nvidia also revealed advancements in robotics, including AI models for humanoid robots and a partnership with Toyota to incorporate its self-driving car technology. Huang, the CEO of Nvidia, has forecasted that robotics will become "the largest technology industry the world has ever seen", with a market for humanoid robots alone projected to reach $48bn (£38bn) within the next two decades. By utilising its AI chips and software, Nvidia aims to transform robotics in smart factories, warehouses, and autonomous vehicles. Huang declared that the robotics industry had reached a "technological turning point" due to advancements in AI that allow robots to learn more efficiently by simulating and analysing vast amounts of real-world data. Nvidia also launched foundational AI models on its Cosmos platform, which have been trained on 20 million hours of video data.

Over the past twelve months, artificial intelligence (AI) discussions have become omnipresent; it's challenging to spend even a brief period without AI featuring in conversation. This surge in interest has been driven by innovations like ChatGPT, which have democratized access to AI capabilities beyond tech experts. Against this backdrop of fervent adoption, cybersecurity company Darktrace anticipates considerable growth poised for the financial year 2024, with projected revenues of $689.5m (£548.71m), as reported by City AM. Moreover, there's now a university dedicated solely to AI—the Mohamed bin Zayed University of Artificial Intelligence (MBZUAI) in Abu Dhabi—established and licensed in March 2020, has enrolled 365 students from 45 different nations. Abu Dhabi's emergence as the site for this institution is not accidental. The United Arab Emirates (UAE) aims to cement itself as an AI global heavyweight, intending, as Telecom Review notes, to channel investments of approximately AED335 bn (£72.6bn) into the sector by 2031. The situation starkly contrasts with that in the UK where the strategy appears less ambitious. Although August saw the government earmark £32m to support 98 domestic AI projects, this came on the heels of a cancelled endeavour to build a £1.3bn supercomputer—a decision slammed by 4J Studios' Chairman Chris van der Kuyl as "idiotic" and likely to trigger a technology brain drain to the US. MBZUAI proudly stands as the first graduate-level university with a dedicated focus on artificial intelligence, offering advanced Master of Science (MSc) and PhD programmes across pivotal domains such as computer science, computer vision, machine learning, natural language processing, and robotics. Targeted at an international student body, MBZUAI is built on the promise of enabling students to delve into innovative AI research alongside top-tier experts in astonishingly equipped facilities. The university caters to experience-rich fields like healthcare, education, and energy sectors through its offerings. With its Incubation and Entrepreneurship Centre (MIEC), MBZUAI aims to transform student concepts into startup ventures, fostering a seamless transition from scholarly research to practical application.

The West of England has long been plagued by age-old stereotypes when it comes to its economic contribution to Britain. Of course the region has a thriving food and drink sector and tourism generates billions for the local economy, but it is also a hotbed of innovation and cutting-edge technology. Giants of aerospace, such as Airbus and Rolls-Royce, are major employers in the West Country while there are high-tech start-ups emerging from the universities at rapid rate. Industries such as nuclear, mining, space and marine tech are also flourishing alongside more traditional sectors, such as financial services and law. The South West is also home to nationally significant schemes such as Gloucestershire’s planned cyber development Golden Valley; Somerset’s Hinkley Point C power station and Bridgwater's Gravity campus, where the UK’s biggest gigafactory is being built; and Plymouth and South Devon Freeport. And then there’s Cornwall’s Goonhilly Earth Station and the Spaceport at Newquay Airport, where the UK attempted the first launch of a satellite from British soil last year. Innumerable business success stories have started in the South West, with many big-name companies choosing the region for their headquarters. Among them are ethical bank Triodos and investment firm Hargreaves Lansdown in Bristol; cosmetics brand Lush in Poole; and engineering company Renishaw in Gloucestershire. The region must be celebrated for its achievements in farming, food and hospitality, there’s no doubt, but it’s got so much more to offer as well. With that in mind, here we take a look at five companies we think are worth keeping an eye on this coming year. In no particular order… The North Somerset robotics company has patented technology to automate wire laying processes for anything from fighter jets to cars to washing machines. The firm was founded in 2018 and its tech is used in areas of manufacturing that are still largely carried out manually. Earlier this year, Q5D secured £500,000 from a top private equity firm as part of a £2m investment round. It has used the cash to expand its testing hub in Portishead and support the delivery of contracts. In November, bosses Chris Elsworthy and Simon Baggott picked up the Manufacturing Innovation award at the Robotics and Automation Awards ceremony in London. This B Corp biotech organisation has developed compostable packaging made from seaweed. The company was founded by Bath University professor Chris Chuck and entrepreneurs Neil Morris and Murray Kenneth, and is now based at the Science Creates incubator in Bristol. The business, which has created a coating that can be applied to paper and card, replacing plastic packaging, raised £4.3m in 2024. It is planning to take its product to market this year. The firm said at the time it would use the investment to recruit more scientists, engineers and commercial staff to conduct large-scale pilots of the material it spent three years developing in the lab. This historic Cornish company’s trailblazing approach to heating homes has caught the attention of Westminster. The family-run firm, which operates across Cornwall, Devon, Somerset, and Dorset, has been supplying a hamlet in Cornwall with hydrotreated vegetable oil (HVO) as an alternative fuel for heating for the last four years. A government select committee visited Kehelland last year where the trial is taking place. HVO is made from waste material similar to cooking oil but it is currently taxed at a higher rate than fossil fuels. Mitchell & Webber is hoping to engage further with the government to highlight the benefits of HVO as an alternative renewable fuel. The Exeter company has developed an AI-powered platform to help businesses hire more diversely. It raised £2.1m in a funding round last year which it said would support job creation and the overall growth of the business. The company’s technology helps firms recruit candidates based on their skill set rather than educational background - as well as hybrid and flexible working. It was founded by Sara Hill in 2019 and was named on a list of 10 early-stage companies considered “at the forefront of technology” across the UK in 2021. Since then, it has gone on to receive backing from major investors.

The boss of data tech firm Cirata says the business has improved on "almost every metric" but has admitted the turnaround has taken a toll on staff. Stephen Kelly, who was brought in to rescue the business in 2023, said he believed much of the hard work had been done and that FY2025 heralded a growth phase. A trading update for the final quarter of last year shows Cirata bookings of $3m (£2.4m) at their strongest since Q2, 2022 thanks to a new contract with a "top three" US bank customer. The Sheffield company's partnerships were now said to be on a stronger commercial footing, and its engineering team now better aligned with the demands of customers. Data integration work, which constitutes 66% of the 2024 bookings total, is thought to be the future of the business with Q4, 2024 bookings of $2.3m (£1.87m). Mr Kelly highlighted some disappointment around establishing greater sales predictability, and slippage on contract closure. Weaker than planned performance in Cirata's international and DevOps businesses resulted in a "disappointing headline outcome for Q4 and the full year". Cash overheads were reduced by about $4m (£3.2m) at the end of the first quarter, 2025. Looking ahead, the firm wants to strike a balance between preservation of long-term working capital and growth initiatives. Mr Kelly said: "This management team came together to drive value creation for shareholders. Phase 1 in FY23 was a company rescue phase. Phase 2 in FY24 was the recovery phase and with the recent cost reductions, this phase is completed. "With FY25, the company is moving into it's growth phase. Q4FY24 brings to a close a year in which we have done much to rearchitect, restabilise and reposition Cirata for more predictable, sustainable growth. The business is improved on almost every metric. We are driving growth in our key Data Integration product on a significantly reduced cost base.

New jobs are being created at a water technology hub in North Yorkshire being developed by an advanced engineering company. Synthotech, based in Harrogate, develops monitoring and leak detection technology for utility companies, tapping into robot technology to slash work times and costs. The business designs and builds advanced pipeline inspection systems and robotics to detect leaks and fix pipes. The robots can be deployed remotely for long distances, speeding up the investigation process, and its AI-capable robots are designed, developed and manufactured in the UK. Now a new technology centre is being created which will create eight jobs, after it secured £7.3m of funding to be used for water and multi-utility no-dig technologies. The centre’s development also comes as the firm releases its latest innovation, the SynthoCAM H20 – a CCTV inspection system which allows water networks to inspect drinking water pipes to make sure their pipelines and working effectively and are free of leaks, without interrupting customers’ water supply. The innovation will prove significant for Synthotech’s clients, as leakage from underground water pipelines is a big challenge to the water industry, with an estimated one fifth of all treated water being lost, adding up to nearly one trillion litres a year across the UK. Synthotech’s innovation division, Synovate, was recently awarded two contracts in Ofwat’s Water Breakthrough Challenge worth £5.8m and it will use its latest robot technology to identify and repair links from within live water mains, without the need for extensive excavations, thereby minimising interruptions to water supplies.

A Bristol prosthetics manufacturer that makes bionic arms for people with limb differences is set to accelerate its expansion overseas after securing £600,000. Open Bionics was founded by Joel Gibbard and Samantha Payne a decade ago and has developed a 'Hero Arm' - a 3D-printed bionic arm with multi-grip functionality that is now available in more than 800 locations in the US, UK, Europe, Australia and New Zealand. The arm has moveable fingers and thumbs that enable below-elbow amputees to pinch and grasp objects. It makes everyday activities like holding a bag or brushing teeth possible for people with upper limb differences. The assistive technology is controlled by special sensors that are activated by muscles in the forearm and are custom-made for the wearer. Open Bionics will use the loan from NatWest to open six more clinics in the US. It will also use the finance to accelerate its expansion into Germany, Austria and Switzerland, it said. Ms Payne said: “We’re really excited to use this funding to supercharge growth in the USA and make it much easier for our patients to access specialist care within their state by visiting their Open Bionics clinic.” Open Bionics, which won the European Healthcare Innovator Award last month in Germany, has also created a 3D-printed partial hand prosthesis called the 'Hero Gauntlet' and a waterproof sports arm called the 'Hero Flex'. The company has manufactured robotic arms for children as young as five in the style of their favourite superheroes. The NHS has made the Hero Arm, Hero Flex, and the Hero Gauntlet devices available to every patient across England, Wales, and Scotland that meets their policy criteria. Open Bionics secured the funding using its intellectual property as collateral. NatWest is currently the only bank in the UK to accept IP as collateral on loans. Using valuations provided by the IP valuation firm Inngot, the lender is enabling scale-ups which lack tangible assets to use their intellectual property to secure finance. Martin Brassell, chief executive of Inngot, said: “Open Bionics’ Hero Arms may catch the eye because of the ‘superhero’ covers they feature, but it’s the tech underneath them that really transforms lives."

A Powys start-up pioneering DNA testing technology as easy to use as a smartphone has secured a six-figure equity investment to support its commercialisation plans. Amped PCR is developing PurifAI which it says revolutionises how industries detect harmful pathogens. It has secured a £350,000 investment from the Development Bank of Wales, in a round also backed with £185,000 from London-based tech investors SFC Capital. The investment bring the PurifAI system, alongside its reagent Amped universal, to a wider market. Founder Ben Davis has more than 15 years of experience in the sector, and is committed to making DNA testing accessible and efficient across industries. Polymerase chain reaction – more commonly known as PCR – is a technique used to amplify normally small amounts of DNA to much larger quantities, allowing anyone testing or analysing DNA to boost the size of the sample available, making it easier for further analysis. Amped PCR is taking this process a step further by incorporating it into the PurifAI system, which allows DNA testing to move from specialised labs to real-world environments like food production sites or environmental monitoring facilities. The PurifAI system is designed to address critical challenges such as high-profile food recalls and the growing need for effective environmental and water testing in the fight against harmful pathogens and antimicrobial resistance. By enabling on-site detection of pathogens like salmonella, listeria and campylobacter, PurifAI allows food producers, environmental agencies and other stakeholders to respond rapidly and proactively, reducing risks and safeguarding public health. Mr Davis said: “We want to improve the user experience so that using this technology feels as intuitive as using a smartphone. Pretty much everyone has a smartphone these days and the technology underpinning them is very sophisticated, but the end user in most cases does not need to know how that all works - it just works. PurifAI is about putting cutting-edge testing power directly into the hands of users, wherever they are and whatever their DNA question may be.” Co-founder Aysha Shah said: “My focus is on making PurifAI intuitive for non-specialist user. By prioritising accessibility and usability, we’re creating a tool that can address major global challenges while fitting seamlessly into existing workflows.” Linzi Plant, assistant investment executive in the Technology Ventures Investment team at the Development Bank of Wales, said:“It was a pleasure to work with Ben and Aysha at Amped PCR as they looked to start up and bring their reagent to a wider market. "The potential uses of their product are huge and it’s fantastic to see a small Welsh company coming up with what could be a revolutionary solution in so many fields of DNA testing.”

Drinks and vending tech provider Vianet has landed a significant contract win with major brewer in the UK. The Stockton-based firm says the agreement with the unnamed, blue chip customer will see it supply its Beverage Metrics draught beer monitoring technology across the country. It will provide performance insights into the customers draught brands. Vianet will begin installations of the tech in this financial quarter and continue phased delivery throughout the rest of the year. The move is expected to grow the group's UK installation footprint by about 5% in the next 18 months, and support Vianet's expansion further into the hospitality sector beyond the leased and tenanted market. The contract follows Vianet's acquisition of US-based Beverage Metrics in 2023. The addition of the Denver company, in a deal worth up to £4.5m, has helped Vianet bolster its "one stop drinks management solution" that can reduce costs, improve productivity and maximise sales. Announcing the contract to investors on the London Stock Exchange, Vianet bosses said it was a strong validation of its tech and strengthened its relationship with The Oxford Partnership - a market intelligence consultancy working with major brewers, who helped Vianet secure the work. The firm said it would help it attract interest from other potential clients. James Dickson, chair and CEO of Vianet, said: "This new agreement represents a strong strategic validation of our investment in Beverage Metrics and the value of our partnership approach. These collaborations are unlocking exciting commercial opportunities within the hospitality sector and beyond, combining our technological capabilities and the Oxford Partnership's analytics and AI expertise. "The phased rollout of our Beverage Metrics solution with a leading global brewer further highlights the innovation and impact of our technology, as it empowers customers to optimize performance and navigate challenging trading conditions effectively. Combined with the encouraging progress we are making in the USA and the recent long-term contract extensions with Heineken's Star Pubs & Bars and Greene King, this milestone underscores the growing recognition of our solutions and their ability to deliver tangible value by helping customers achieve more with less."

Sheffield data firm Cirata has announced a deal worth around $2m with IBM which will support a top three US bank – its biggest contract since the firm restructured last year. The business – which also has offices in Newcastle, Belfast, California, China and Japan – said the live data migrator (LDM) contract is the biggest of its kind with IBM to date, and will start on December 31. Cirata said it sees the contract as the “next step” in its ability to provide long-term support to the banking customer as it builds out its data architecture and implements Cirata’s product “into one of the most demanding enterprise environments”. The firm said: “The LDM contract also represents the first transaction completed under the terms of the new OEM agreement to integrate Cirata’s LDM technology inside IBM’s Big Replicate solution, previously announced on 2 October 2024. This will be the largest value contract for LDM since the restructuring of the company in March FY23, the largest LDM contract to date in financial services and the largest implementation through the IBM Big Replicate platform. Following the deal announcement Cirata said it had withdrawn its financial year 2024 bookings guidance, due to some major customers opting for one-year terms rather than multi-year terms, as well as movement of pipeline opportunities and bookings from the end of this financial year into the first half of 2025. New guidance will be issued in its regular quarterly trading update. Stephen Kelly, CEO of Cirata, said: “Cirata has set itself the challenge of delivering its LDM product to meet the needs of the most demanding enterprise technology environments. The announcement of the LDM contract through IBM Big Replicate proves Cirata is well positioned to meet those needs. We look forward to shaping a long-term relationship with this top 3 US bank as they build out their data architecture in response to the rapidly changing AI and Machine Learning landscape. “The recent renewal of our OEM agreement with IBM set the stage for the closure of this LDM contract, and so the win itself is doubly important. It is not only the largest transaction in the Company’s history for LDM within financial services, it is also the largest implementation of LDM for Big Replicate through our highly valued partner IBM. “While today’s announcement is a clear signal of our technology’s capabilities and our own ability to build commercial trust, it is also a reminder that large contracts can make our business lumpy and that forecasting has indeed proved challenging. In parallel with the announcement of this new contract, Cirata withdraws its FY24 bookings guidance. This is mainly due to the LDM contract and one other contract being of a one-year rather than a multi-year term and the movement of pipeline opportunities and bookings expectations from Q4 FY24 to H1 FY25, which has caused a sufficiently wide variation to expected outcomes for bookings. Our focus continues to be on the long-term potential of our support for this top US bank, our partner IBM and our other customers. “I thank our colleagues for getting us towards the end of the recovery phase of the company. We inherited a broken business from a peak annualized cost base of $45m per annum to a company exiting FY24 with a cash overhead of circa $20m per annum. Our cash burn in Q1FY23 was an unsustainable $11m per quarter and as we exit Q4, Cirata will be on a path towards cash flow breakeven. "That adjustment has involved more than halving the workforce, with all the trauma that entails. However, our colleagues are responding to that challenge by building and hardening a differentiated product and selling successfully into one of the most demanding environments in IT. The Data Integration product performance has improved from -87% decline in Q1FY23 to 180% growth in the last reported quarter, Q3FY24.

The 'Magnificent Seven' tech giants, namely Apple, Nvidia, Microsoft, Amazon, Alphabet, Meta and Tesla, saw a combined growth of 63 per cent in 2024, building on the strong performance of 2023. Deutsche Bank disclosed that these companies generated more profit in 2024 than most national stock markets, as reported by City AM. However, JP Morgan has predicted a decline in their contribution to S&P 500 earnings growth from 75 to 33 per cent in the coming year, indicating potential challenges. Will they maintain their market dominance this year? Here's an analysis of their prospects for 2025: Apple, a much-loved brand, reported robust sales in 2024, with its privacy features and ecosystem retaining customer loyalty. However, service growth fell short of expectations, and innovation in hardware seemed subdued. Susannah Streeter, Head of Money and Markets at Hargreaves Lansdown, suggests that the company's focus on AI could steer it in a new direction in 2025. Despite a five per cent cumulative revenue growth over the past three years, the consensus is for seven per cent growth in 2025, keeping expectations high. However, its stock has only risen 41 per cent over the past three years, underperforming the 51 per cent increase in the information technology index. Microsoft, meanwhile, cemented its place at the heart of the AI revolution in 2024, with Azure revenue up by 34 per cent, as per Streeter. The integration of AI tools like Copilot across its software suite has impressed analysts. In the forthcoming year, cloud computing competition and increased regulatory scrutiny could challenge its growth trajectory, yet the discontinuation of Windows 10 support might trigger an upgrade cycle, according to Dan Niles, founder of AlphaOne Capital Partners. He recently expressed on LinkedIn that the termination of Windows 10 "could also lead to some upgrades in their core PC business while a ramp in AI PC demand is a hope for some point in the future". Amazon's Cloud AWS remained a key growth driver in 2024, with a 19 per cent revenue increase as global AI adoption soared. E-commerce margins saw a rebound following the company's cost-reduction strategies. Streeter noted, "margins have recovered after the huge cost-saving drive with worldwide layoffs." Amazon may emerge as the top performer for 2025, having surpassed both revenue and margin expectations in the latest quarter. However, Nile pointed out the potential for a challenging start to 2025 due to uncertain consumer spending patterns, fewer shopping days, and less favourably timed holidays. For Meta, the tech behemoth's strategic downsizing yielded positive results in 2024, evidenced by a five per cent increase in daily active users. Its investment in AI has improved ad targeting and content curation, bolstering advertiser trust. Yet, the question remains whether Meta can maintain its growth momentum into 2025 without the previous year's tailwinds from political elections or major events like the Olympics, which had contributed to heightened user engagement. "If its revenue doesn’t keep up", warned Streeter, "margins may come under pressure, deterring its investors". Alphabet, the parent company of Google, also posted strong results in 2024, driven by its cloud business and AI advancements. However, the ongoing case by the US Department of Justice against Google’s search monopoly casts a shadow over the firm’s 2025 outlook. Sundar Pichai, the Chief Executive, highlighted the importance of utilising AI to accelerate progress and solve real-world problems. The company made headlines towards the end of 2024, as Pichai prepared his employees for an important, "pivotal" year ahead, while also alerting them to potential challenges. Tesla begins to lose momentum. Tesla experienced a surge of optimism in 2024, with its stock increasing by 63 per cent, partially due to Elon Musk’s advisory role in the Trump administration. However, a decrease in EV demand and the potential loss of tax credits in 2025 could impact the company’s sales. Therefore, Tesla's ability to scale production of its affordable electric vehicles and expand self-driving capabilities will be crucial for 2025. Nvidia was largely the leader of the Magnificent Seven group in 2024, overtaking Apple as the world’s most valuable company with its shares rising by 171 per cent amid surging AI demand. Despite taking a slight hit at the end of 2024, according to Investopedia, the firm’s sales and earnings flourished. Moreover, Nvidia's Blackwell super chip and dominance in AI infrastructure are positioned for continued growth in 2025.

Tyneside volunteering app onHand has secured a £750,000 investment to help companies to improve their corporate responsibilities through its social impact platform. The onHand app was launched five years ago by Sanjay Lobo and has been described as ‘Uber for volunteering’, offering firms a way to engage and support employee wellbeing. It has been used by a number of businesses around the UK to help employees complete thousands of sessions to help local communities. Now Northstar Ventures has led a £750,000 investment round into the social impact platform, with £325,000 invested by the North East Innovation Fund supported by the European Regional Development Fund and £175,000 from Northstar’s EIS Growth Fund, alongside investment by 24 Haymarket. Total investment in OnHand to date now tops over £5m, including two lots of backing from Shazam’s co-founder Dhiraj Mukherjee. Since Northstar Ventures’ initial investment in 2021, the business said it has acquired a diverse array of clients and it has just scooped 22nd place on Deloitte’s Fast50 of fastest growing tech businesses for 2024. CEO and founder Sanjay Lobo recently appointed CFO Will Turner, a proven expert in scaling SaaS metrics, having played a key role in growing Amplience from £3m to £25m in annual recurring revenue. Mr Lobo said: “Delighted to have the continued support of Northstar Ventures, who invested in OnHand at such an early stage, and 24 Haymarket following their initial investment. The next stage for us is helping even more enterprise businesses deliver incredible social impact in their local communities and building a culture of purpose at work.” Naomi Allen Seales, investment manager at Northstar Ventures, said: “It’s no surprise that OnHand is thriving, thanks to their exceptional leadership team. Our investment will support technical improvements to enhance the platform’s gamification and expand user options even further. It will also help the company achieve their ambition of breaking into the enterprise market. We are thrilled to support such an exciting, innovative company, as we recognise the value of corporate volunteering.”